Special news coverage and analysis on The Buchanan and Seaton Show w/ @davidaseaton and live streams on WVON or WVON 1690AM on iHeartRadio Friday at 9pm – midnight Central

The average student loan borrower pays $393 per month, according to the Federal Reserve. According to the Center for American Progress student loan debt totals 1.5 trillion dollars. That’s trillion with a “t”. There is a lot of discussion right now about the next or future stimulus bills including student loan reduction of elimination. It’s no wonder as the cost of education has increased over 100% in the past few decades.

Right now student loans are repaid to banks. If you have a bulk of money invested in bank stocks, then you want to see student loans continue to be repaid over their 10+ year schedule. Given that the bankruptcy laws were re-written so that borrowers can discharge student loans in bankruptcy except for very specific circumstances, this is a guaranteed return on your investment as an investor. Let’s examine how the entire economy would benefit from student loan forgiveness.

Aside from the banks and their shareholders making profits, there is nothing stimulative about student loans. In addition to that reality, banks like Wells Fargo are laying people off and the rich, who are the biggest holder of stocks in general, are spending less money.

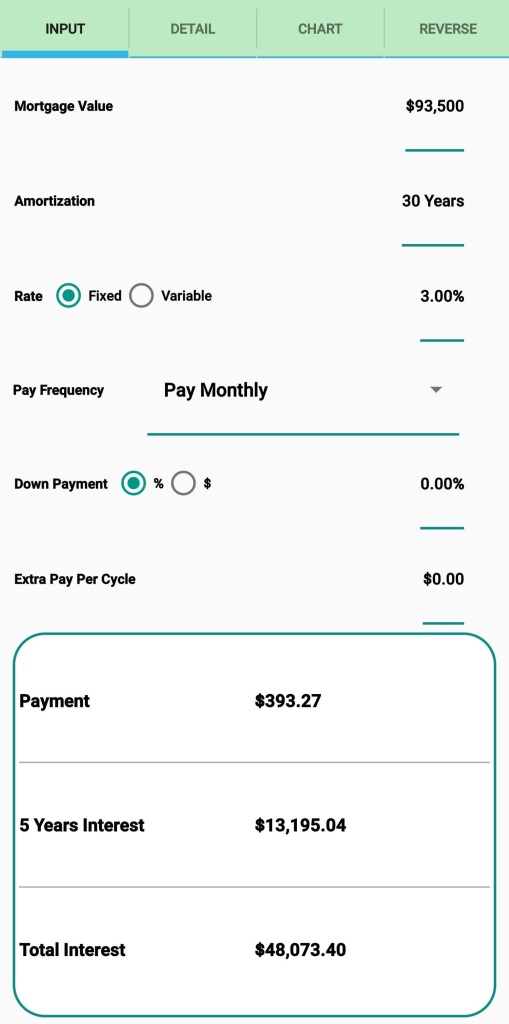

The question becomes what could the average person do that would be stimulative to the economy if we eliminated all student debt? Remember the average payment is $393.00 per month? Interest rates on mortgages are below 3%. That $393.00 is the payment on a 30-year mortgage of $93,500.00 or an additional $93k one qualifies for once that student loan debt is eliminated.

This purchase is not only economically stimulative, but it also has a multiplier effect. When most people purchase a home, they get a loan from a bank. There are dozens of people who work at the bank who process your loan. You hire an appraiser and an inspector to evaluate the home. There’s a realtor, often two, who are involved in the purchase. One goes to a title company to actually close on the loan. Finally you often hire an attorney.

Once you buy your new home, now you have to furnish it. You perform home improvements. Most of all, and this is the biggest reason to eliminate student debt, a homeowner pays property taxes. This revenue stream is the foundation of our entire society. It funds everything from schools, to public works, police and fire departments, roads, everything.

In the 10 years it would take to repay a student loan of $30,000, that money can be repurposed to fund our towns and cities. It has the added benefit of creating stable families where wealth is created to fund the next generation of citizens.

Maybe you buy a $30,000 car at 0% interest for six years, which would be approximately $400.00 per month. How many jobs benefit from that purchase? Perhaps you take out a HELOC on your home and start a business and employ people who need a job. Maybe you take that $30k and purchase an investment property and provide housing to someone else who can’t buy a home. The point is that student loan debt is preventing 1.5 trillion dollars of economic activity that would be extremely beneficial and is sorely needed right now.

There is a group of people out there who object. “I paid my student loans, so everyone else should have to pay theirs.” If you are one of those fortunate people who either never had to get a student loan or had enough income to pay yours off, then to you I say congratulations. However, given the reality of the economy, Covid-19, people losing jobs and income, and the stability of the economy, this is not the time for individual gripes about fairness.

Elizabeth Warren and the progressive wing of the Democratic party understands and endorses this theory to help the middle class. While Senator Warren proposed the elimination of all student debt since running for the Democratic nomination, the majority of the Democratic party is pushing for the elimination of $10,000.00 in student debt in the next stimulus bill (they have been pushing for this since the original Cares Act in March) Trump and the Republicans have stated that we can’t afford it. This after spending trillions of dollars to prop up private business.

This is a unique moment where we as a society have to decide how we are going to deploy our finite resources. Should it be for the benefit of a few banks and stockholders, or should it be for the benefit of all?

Do you have a student loan? If student loan forgiveness passed what would you do with that added income?